Helping Parents build connections one day at a time through laughter, fun, and shared experiences with their kids!

Looking for more?

Shop the Store!

Visit our digital printable store for games, fun printables, crafts, and more!

EASTER IDEAS

SPRING IDEAS

Are you trying to find simple, affordable ways to connect with your kids?

Let’s connect!

Ideas by Theme

Welcome Friends!

MY NAME IS MICHELE! I AM SO GLAD YOU ARE HERE!

I AM A WIFE AND A MOM OF FIVE KIDS BASED IN DALLAS, TEXAS. THROUGH MY YEARS OF BEING A MOM, MY TRAINING TO BE A FAMILY LIFE EDUCATOR, AND MY DEGREE IN MARRIAGE AND FAMILY STUDIES, I KNOW FIRSTHAND HOW DIFFICULT IT IS TO RAISE A FAMILY THESE DAYS, AND I AM HERE TO HELP YOU EVERY STEP OF THE WAY!

I WILL NOT ONLY SHARE REAL-WORLD EXPERIENCE WITH YOU BUT ALSO EVERYTHING I HAVE LEARNED IN AND OUT OF THE CLASSROOM.

I AM PASSIONATE ABOUT TEACHING FAMILIES TO BE SUCCESSFUL AND CREATE LONG-LASTING MEMORIES WITH ONE ANOTHER.

Just For Teens

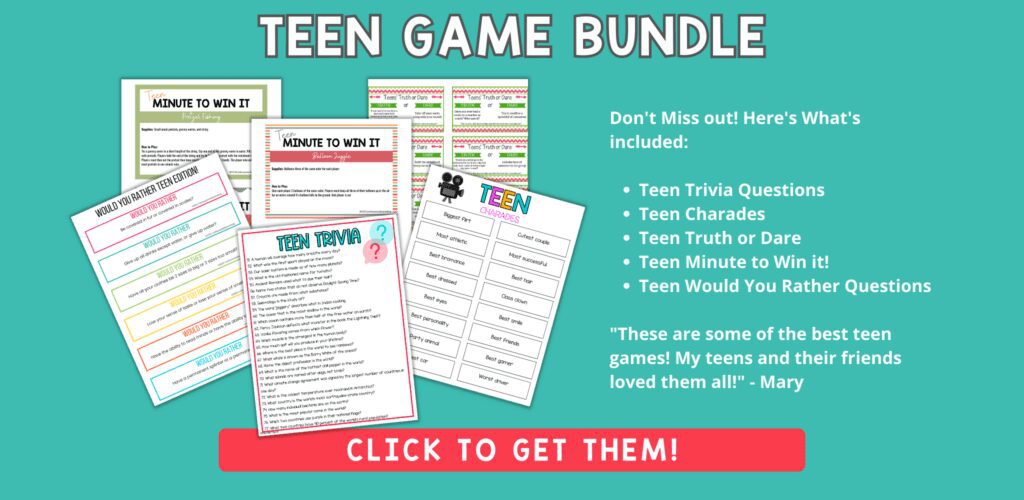

Fun GAMES

Bingo games

Charades ideas

truth or dare fun

WOULD YOU RATHER…

See All Would You Rather Questions

Trivia questions

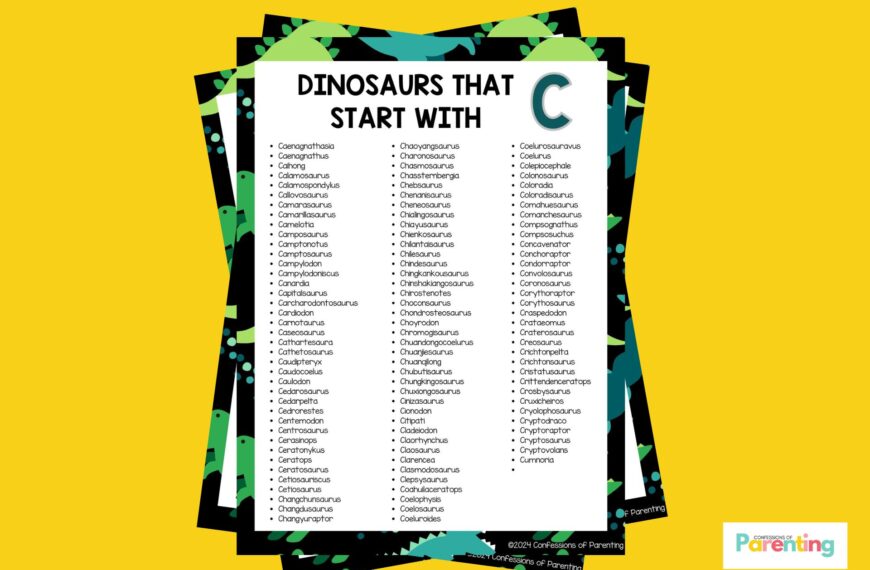

Fun Learning activities

Find More Learning Activites

Funny jokes & puns

Laugh with More Jokes and Puns

Funny RIDDLEs

Find More Riddles

Readers’ favorites

latest Posts

More Posts You’ll Love

As Seen on

![The Best 80’s Trivia Questions [Includes Music & Movies]](https://confessionsofparenting.com/wp-content/uploads/2024/02/80s-trivia-questions-870x570.jpg)

![The Best 90s Trivia Questions [Includes Music and Movies]](https://confessionsofparenting.com/wp-content/uploads/2024/02/90s-trivia-questions-870x570.jpg)

![50+ Fun Pregnancy Announcement Riddles [Free Riddle Cards]](https://confessionsofparenting.com/wp-content/uploads/2023/04/pregnancy-announcement-riddles-2-870x570.jpg)

![129 Halloween Would You Rather Questions [Free Printable]](https://confessionsofparenting.com/wp-content/uploads/2021/11/halloween-would-you-rather-4-870x570.jpg)